The Rise of Fintech: Revolutionizing India’s Financial Landscape

The Rise of Fintech: In a country where over 10 Billion digital payments are being made every month. An impressive 75% of all retail digital payments in India are facilitated through the Unified Payments Interface (UPI). The magnitude of these figures showcases the massive shift from traditional cash-based transactions to digital alternatives in India. Moreover, It demonstrates the growing trust and acceptance of digital payments. So, now you must have understood the great potential of fintech in India.

Now let’s deep dive into what is fintech and how it revolutionized India’s financial landscape.

What is Fintech

Fintech stands for financial technology which refers to the innovative use of technology in the financial sector. It encompasses a range of applications and services that leverage digital platforms, data analytics, and advanced software to transform traditional financial processes.

Fintech companies in India provide solutions for various areas, including mobile banking, online payments, cryptocurrency, lending, wealth management, and insurance. By streamlining operations, improving customer experiences, and increasing accessibility, fintech has revolutionised the financial industry.

It enables faster transactions, promotes financial inclusion, and empowers individuals and businesses to manage their finances more efficiently. Fintech continues to evolve, driven by advancements in artificial intelligence, blockchain, and open banking, promising a future of enhanced financial services.

Rise and Future Growth of Fintech in India

The fintech industry of India has acquired a place among the fastest-growing fintech markets in the world. In the year 2021, the Indian Fintech industry market size was $ 50 Billion.

Furthermore, According to Invest India, it is expected to grow up to $150 Billion by 2025. With a large unbanked population, increasing smartphone penetration, and supportive government initiatives like digital payments and financial inclusion, the sector has thrived. Moreover, Fintech innovations have disrupted traditional banking, enabling convenient payments, lending, insurance, and wealth management services.

The future holds immense potential as fintech continues to expand in areas like blockchain, AI, and open banking. Collaborations between fintech startups, traditional financial institutions, and regulatory advancements will further fuel the growth, making India a thriving hub for fintech innovation and financial empowerment.

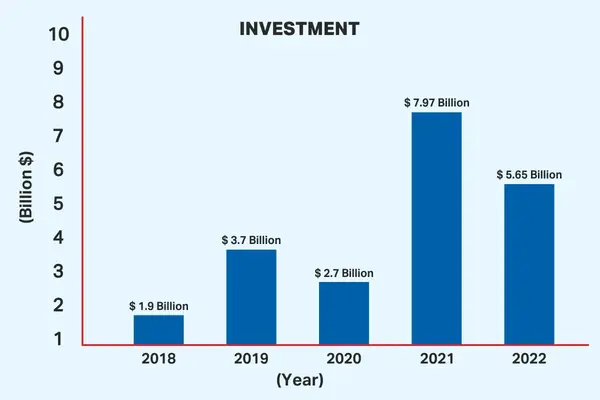

Year-wise Fintech Investments

10 Most Successful Fintech Companies In India

These are the top fintech companies in India that currently have the status of a unicorn startup or have been valued at less than $1 billion in recent years.

- Paytm: A leading digital payments platform offering mobile wallet services, online payments, and digital banking solutions.

- PhonePe: A popular UPI-based payment app enabling secure and convenient transactions, backed by Flipkart.

- Razorpay: A payment gateway and online payment solutions provider for businesses, facilitating seamless transactions.

- PolicyBazaar: An online insurance aggregator platform offering a wide range of insurance products and comparison services.

- Instamojo: Instamojo is an Indian fintech company that offers a comprehensive platform for small businesses to start, manage, and grow their online presence by providing payment solutions, online stores, and more.

- Zerodha: India’s largest retail stockbroker, providing a digital platform for investing in stocks, mutual funds, and commodities.

- MobiKwik: A digital wallet and mobile payments platform allowing users to make payments, recharge, and avail of financial services.

- Lendingkart: A digital lending platform providing quick and hassle-free loans to small and medium-sized businesses.

- CRED: A credit card payment and rewards platform that incentivises users for timely credit card bill payments.

- Moneytap: Moneytap is a fintech company in India that offers a credit line platform, allowing users to access flexible and instant loans directly through their mobile phones.

10 Kinds of FinTech Industries

Below are the 10 FinTech Industries of India and information on what it deals with.

- Payments and Remittances: Fintech companies have revolutionized the way payments are made, offering digital wallets, mobile payment apps, and peer-to-peer transfers that are faster, more secure, and more convenient.

- Lending and Credit: Fintech platforms have disrupted traditional lending models, providing alternative sources of credit such as peer-to-peer lending, crowdfunding, and digital lending platforms that leverage data analytics and automation for faster loan approvals.

- Wealth Management and Investing: Fintech has democratized investing by offering robo-advisors, online trading platforms, and investment apps that provide easy access to diversified portfolios, personalized recommendations, and lower fees.

- Insurance Technology (InsurTech): InsurTech has simplified insurance processes, from policy issuance to claims management, by utilizing technologies like artificial intelligence, IoT, and data analytics to streamline operations and improve customer experiences.

- Personal Finance and Budgeting: Fintech solutions have transformed personal finance management, offering budgeting apps, expense-tracking tools, and digital financial advisors that empower individuals to monitor and optimize their finances.

- Blockchain and Cryptocurrency: Fintech has played a significant role in the development and adoption of blockchain technology and cryptocurrencies, enabling secure and decentralized transactions, smart contracts, and innovative financial products.

- Agrifintech: Agrifintech is the application of financial technology in the agricultural sector. It uses digital platforms and financial services to address challenges in farming, rural finance, and supply chain management. Agrifintech aims to improve productivity, financial inclusion, and sustainability in agriculture.

- Crowdfunding fintech: Crowdfunding fintech refers to the use of financial technology platforms to raise funds from a large number of individuals, typically through online platforms. It enables businesses, entrepreneurs, and individuals to access capital by collecting small contributions from a diverse group of investors. Crowdfunding fintech platforms facilitate efficient and transparent fundraising processes, connecting investors with projects or ventures seeking financial support.

- Neobanks fintech: Neobanks in fintech are digital-only banks that operate exclusively online without physical branches. They offer a range of banking services such as deposits, payments, loans, and budgeting tools through mobile apps or websites. Neobanks focus on providing a seamless user experience, and innovative features, and often leverage technology partnerships to deliver their services.

- NFT fintech: NFT fintech refers to the intersection of non-fungible tokens (NFTs) and financial technology. It involves the application of fintech principles and services to NFTs, such as NFT marketplaces, fractional ownership, lending, insurance, and investment platforms. NFT fintech aims to enhance the accessibility, liquidity, and utility of NFT assets in the financial ecosystem.

Also Read: Exploring the Benefits of an International Accounting and Finance Course

Recent Post